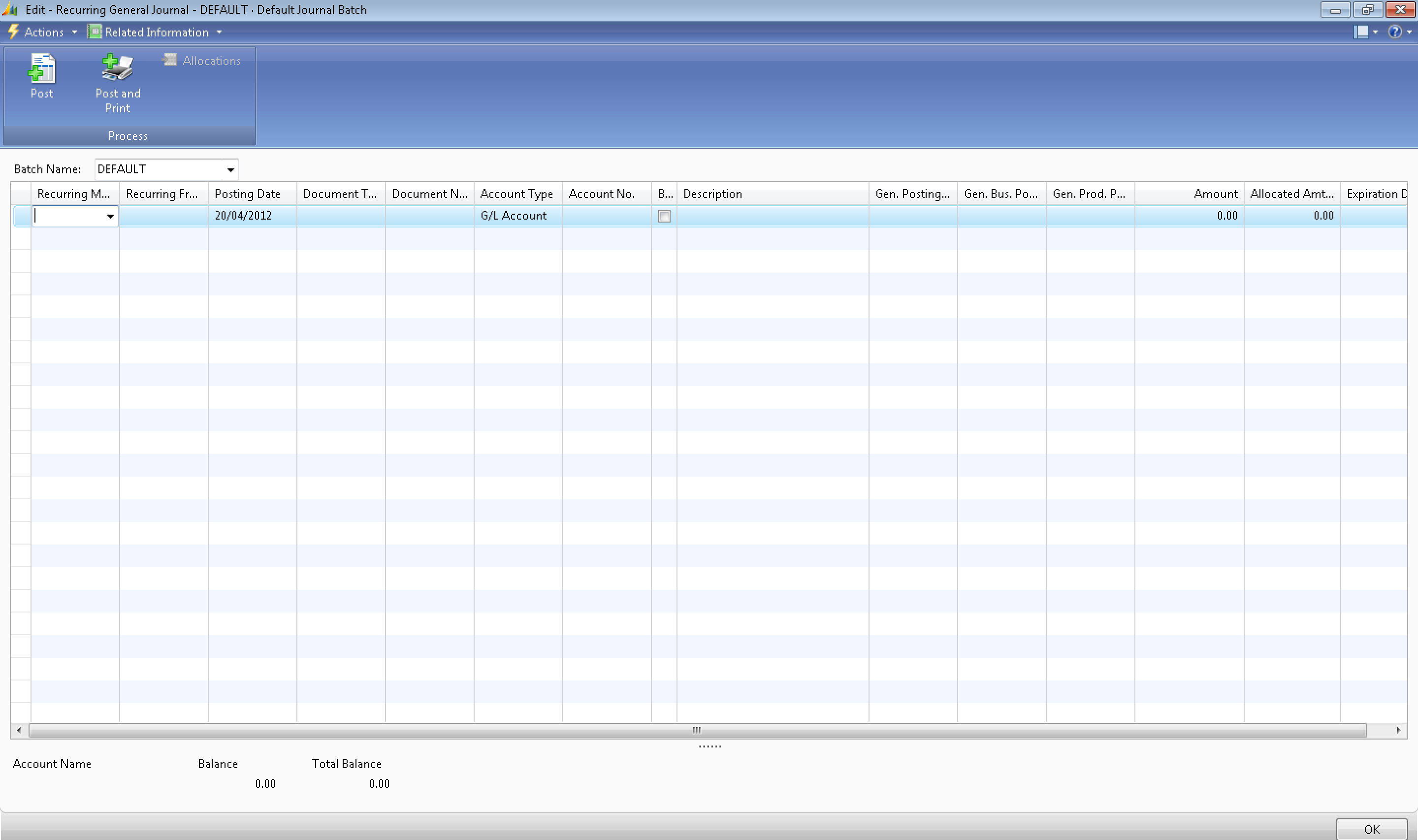

Recurring and Reversing Journals

Recurring Journals in Microsoft Dynamics NAV can be used for a number of accounting functions. Each line in the journal can be assigned a formula to determine how the system should handle the entry.

A Recurring Journal differs from a general journal by having two additional fields. The first additional field is where you are required to select the Recurring method, which determines how the system should handle the transaction and the second being the recurring frequency which determines how often this transaction needs to be processed.

The Recurring Methods are as follows:

Fixed (F) : The journal line will be exactly the same each time it is processed. That is each field will remain the same apart from the posting date field. This type of journal can be used for fixed price expenses that recurr on a monthly basis.

Variable (V) : The journal line will be the same each time it is processed apart from the amount and the date. This type of journal can be used for monthly expenses that are recurring but the amount changes.

Balance (B) : This journal line will post out of one account or dimension value and reallocate accross one or more accounts or dimensions by percentage or amount. This type of journal can be used for reallocating costs accross departments on a monthly basis.

Reversing Fixed (RF) : This is a Fixed type of journal as mentioned above but will process the transaction and the reversal the next day. This type of journal can be used for accruals where you want the transaction to post on the last day of the month and reverse the first day of the following month.

Reversing Variable (RV) : This is a Variable type of journal as mentioned above but will process the transaction and the reversal the next day. This type of journal can be used for accruals where you want the transaction to post on the last day of the month and reverse the first day of the following month, but where the amount changes on a monthly basis.

Reversing Balance (RB) : This is a Balance type of journal as mentioned above but will process the transaction and the reversal the next day. This type of journal can be used for accruals where you want the transaction to post on the last day of the month and reverse the first day of the following month.

The Recurring Frequency field uses a formula the needs to be entered by the user. It can contain a maximum of 20 characters consisting of numbers and the letters that the program recognises as abbreviations for time specifications. They can be entered as follows:

- If the journal line must be posted every month, enter "1M". After every posting, the date in the Posting Date field will be updated to the same date in the next month.

- If you want to post an entry on the last day of every month, you can do one of the following:

- You can post the first entry on the last day of a month and enter the formula 1D+1M-1D (1 day + 1 month - 1 day). With this formula, the program calculates the date correctly regardless of how many days there are in the month.

- You can post the first entry on any arbitrary day of a month and then enter the formula: 1M+CM. With this formula, the program will calculate one full month + the remaining days of the current month.